October 2023

Language: Estonian (Original title: Kinnisvarabrändide tuntus ja maine 2023)

Format: MS Power BI

About this report:

In order to achieve sustainable growth and competitive advantages in the real estate development industry, it is essential to have a comprehensive understanding of consumer needs and desires. This knowledge should be utilized in the early stages of project development. While the budget sets clear boundaries for homebuyers, it's important to recognize that within these boundaries, there are various alternatives to choose from during the home search.

Kantar Emor has been mapping the needs of residential real estate buyers, their previous customer experiences, as well as the recognition and reputation of different real estate development brands in the Tallinn (Suur-Tallinn) area since 2017.

Our research results assist developers in gaining a better understanding of customer needs and preferences in the Tallinn and its vicinity real estate market.

Table of contents:

Needs. Ideal Home.

- Region Advantages

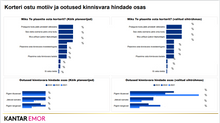

- Apartment Purchase Motivation and Expectations Regarding Real Estate Prices

- Preferences for House and Apartment Size

- Layout Preferences

- Room Usage Purposes

- Kitchen Solution Preferences

- Bathroom Solution Preferences

- Preferences for Storage Space and Balcony

- Willingness to Pay an Additional Fee for Air Conditioning

- Parking Space Preferences

- Attitude Towards Commercial Spaces in the Building

Develope

- Reasons for Purchasing a New Home

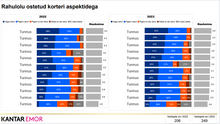

- Satisfaction with Purchased Apartment Aspects

- Aspects that Cause Dissatisfaction

- What people miss from new home

- Satisfaction in Relation to NPS (Net Promoter Score)

- Satisfaction Aspects Depending on NPS Segment

Developers' reputation

- Reputation of 2023

- Trend of recognition

- Reputation ranking of real estate developers

- Reputation Indicators

- Developer image

List of real estate developer brands included in the survey:

Merko, Endover, Liven, Bonava, YIT Eesti, Arco Vara, Kaamos, Hepsor, Astlanda, Invego, Nordecon, Fund Ehitus, Oma Ehitaja, Pind Kinnisvara, Pro Kapital, Domus Kinnisvara, Uus Maa, 1Partner, Hausers Grupp, Metro Capital, Triple Net Capital, Everaus, Mitt&Perlebach, Scandium, LVM Kinnisvara, Rand&Tuulberg, Avalon, Novira Capital

Methodology

CAWI (Computer Assisted Web Interviewing).

Target group:

- Prospective Buyers in Tallinn New Developments:

- 25-65-year-old Estonian residents

- Planning to purchase a new apartment in Tallinn new developments within the next couple of years

- Referred to as "Planners" in charts and tables.

- Experienced Buyers of Apartments in Tallinn New Developments:

- 25-65-year-old residents who have purchased apartments in Tallinn new developments within the last 5 years

- Referred to as "Recent Buyers" in charts and tables.

Sample size: 430

- Planners – 244 respondents

- Recent Buyers – 249 respondents

Technical and payment information

This report is delivered electronically as interactive Power BI dashboards.

A link providing access to the Power BI report will be emailed to you within two business days upon confirmation of your payment. The user license is intended exclusively for internal use and is valid for a user group ranging from one to five individuals (1-5 emails). This access link remains active for 365 days starting from the date of dispatch. Should you require access for more than five users, extra fees will be incurred for each additional user.

**VAT is added to the price at the checkout before the payment is completed.

This price is for access to the data for one year.

This is a market research report. Usage terms and policies apply to the content. Please read these carefully before ordering.